Free lesson

Try for free

Get a personal discount

Leave a request - we will tell you about discounts and select a course for you for any purpose and budget

By clicking on the button, I agree to the processing of personal data and to the terms of using the platform

Courses

Mini-courses

Business/Personal travel

Accounting. VAT on automobile expenses and tax allocation

Accounting. Buying, renting or leasing an automobile

Private use of a company car of EPF

Service or private transport of EPF

Freight transportation. Calculation of taxes for private use

Passenger vehicle at AS. Calculation of taxes for private use

Income tax at EPF Private Entrepreneur (EPF)

The automobile in business

In this course we will cover several important topics related to the use of cars and trucks in joint stock companies and individual entrepreneurs. What expenses can be accounted for in the company, the possibility of receiving MVA (VAT) deduction, methods of calculating tax liabilities in case of personal use of a company car, and we will also consider the issues of choosing between purchasing, renting or leasing a car. You will get answers to these and other questions that may arise in the context of the use of motor vehicles in your business.

The most up-to-date information is presented in a convenient and accessible format: videos, presentations, texts and tests. You can take the course anywhere in the world, all you need is a phone, tablet or PC.

Course contents

Module 1

Use of a personal car in business

Module 2

Use of a corporate or personal car by an individual entrepreneur (EPF)

Module 3

Use of a corporate vehicle for personal use by a private entrepreneur (EPF)

Module 4

A passenger car as a corporate vehicle in a joint stock company (AS)

Module 5

A truck as a corporate vehicle in a joint stock company (AS).

Module 6

Accounting. Buying, renting or leasing an automobile

Module 7

Accounting. VAT (MVA) on vehicle related expenses and other tax liabilities

Teacher assistance and a closed community

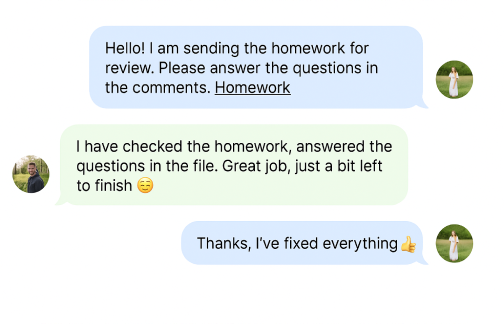

An attentive teacher helps you to correct mistakes in your practical work, shares tips and tricks and recommends useful literature.

In the private chat room you communicate and share useful materials with other users of the platform. And the teacher answers questions about the course and gives guidance on how to complete assignments.

Learn from a convenient online platform

No textbooks or printouts

You can study anywhere in the world, all you need is your smartphone or laptop

We will help you choose!

If you don’t know which course to choose or have questions about the format, leave your contacts and we will advise you by phone or email.

Takk for din forespørsel!

Vi vil kontakte deg snart